For Valio, 2018 was variable. The global milk market supply exceeded demand, which reflected in the prices for both Finnish and export sales. We continued to see moderate growth in our turnover, and we launched completely new categories during the year. We continued our sustainability work throughout the supply chain, and we initiated partnerships in various projects, with the goal of resetting milk’s carbon footprint by 2035. From a business perspective, 2019 has been proceeding in the right direction.

Valio Group’s turnover was €1,734 million (1,709), which means a growth of 1.5 percent compared to the previous year. Net sales in Finland grew by half a percent, and net sales abroad grew by 3 percent. Our milk margin* was €800 million (797) and our milk return** was 38.4 percent per litre (37.9).

The situation on the global milk market, however, remained challenging. Supply exceeded demand, which reflected in the prices for both Finnish and export sales. It was a challenging year for Valio’s owner-entrepreneurs: milk prices fell and the summer was record-setting hot and dry.

Valio and four other dairies reached a settlement in late 2018 and early 2019 in a compensation process regarding base milk pricing. One-off compensation pay-outs resulting from this process were a burden on Valio’s operational profits.

“The greatest challenges arise from the dairy industry’s operating environment. Global milk production continued to grow, and last year we saw that weather conditions can have a significant effect on production conditions, both in Finland and around the world. The feed shortage resulting from the record-dry summer was an additional burden on the farms’ financial situation,” says Valio CEO Annikka Hurme.

In the Finnish market, Valio’s turnover grew by roughly half a percent compared to the previous year, which is a good performance in a tight competitive space. This growth was supported by the successful development in our product portfolio as well as a strong supply chain.

From a renewal and innovation perspective, 2018 was strong. In February 2018, we launched our plant-based Valio Oddlygood® products in Finland and Sweden. In March, Valio returned to the ice cream market with its Valio Jäätelöfabriikki™ premium ice creams after a 14-year break. In summer, we renewed our Valio ProFeel® range of protein products and introduced numerous new protein snacks. Of our more traditional categories, basic milk products continued to along a downward trend, consistent with market trends.

Our foreign operations produced a turnover of €669 million (649). Valio’s growth continued especially in Sweden, the Baltics, Russia, and China.

“In 2018, our turnover in Sweden grew by 10 percent thanks to added-value products, such as lactose-free products. Our turnover growth in the Chinese market was also strong. Valio remains an unknown brand in China, and it takes time to build recognition and create profitable growth. In Russia and the USA, we are focusing on improving operational profitability. Development in these markets in 2019 has remained along those lines,” says CEO Annikka Hurme.

Solving the climate challenge and promoting animal welfare

Since the beginning of 2018, we began paying a sustainability bonus of one cent per litre of milk to dairy farmers that commit to, among other things, planned and preventive animal healthcare with a veterinarian.

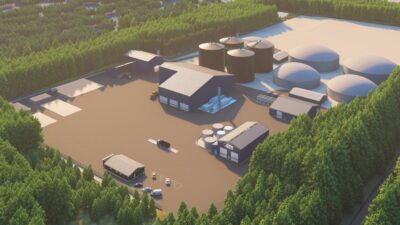

The Intergovernmental Panel on Climate Change (IPCC) report, released in late 2018, brought global warming and the means to mitigate it to the forefront. In October 2018, Valio set an ambitious climate goal: we want to cut milk’s carbon footprint to zero by 2035.

“We know the climate and environmental impacts of milk production, and we are actively working to reduce them. My vision is that dairy farmers and other agricultural operators can come together and become a part of the solution to climate change and the future food supply. As we work towards reducing milk’s carbon footprint, we also want to introduce new points of view when assessing food production’s climate impacts: the nutrition angle should be considered when looking at the carbon footprint of food,” continues Hurme.

Proceeding in the right direction

The development of Valio’s business in 2019 has started with a positive trend. Net sales growth early in the year has been fuelled by, among other things, rising milk powder prices in the global market. Valio’s three-year project to improve cost-effectiveness and competitiveness and through them, the milk return, was started in 2018 and is proceeding as planned.

Valio Group key figures in 2018

| 2018 | 2017 | Change | |

| Net sales, M€ | 1,734 | 1,708 | +1.5% |

| Milk margin, M€ | 800 | 797 | +0.4% |

| Milk return, c/l | 38.4 | 37.9 | +1.3% |

| Milk volume, ML | 1,821 | 1,837 | -0.9% |

| Equity ratio | 44% | 45% | -1%-pt. |

| Investments, M€ | 62 | 98 | -36.7% |

*Net sales less all other costs excluding the price paid to the owners for raw milk, interest on shareholder loans, depreciation according to plan, supplementary payments to the pension fund, pension contribution refunds, and items not included in actual business operations, such as sales gains from sales of business operations, and provisions. The milk margin includes taxes for appropriations, and the tax effect of Valio Ltd profit less the tax share of the net profit corresponding to the amount of the average dividend percentage from the share capital.

** Milk margin less estimated required financing for investments, and the figure is divided by the milk volume taken in from the owners of Valio Ltd.